Cybersecurity spending analysis of the final quarter 2022

Cybersecurity continues to be in trend according to the market analysis. Spending on cybersecurity projects continued growing steadily in the last quarter of 2022, however, the direct sales seemed to go down. Channel sales rose on the other hand.

According to Canalys, the overall spending on cybersecurity technology remained strong in Q4 2022, with significant channel sales offsetting the decline in direct sales. The market grew by 14.5% to $19.6 billion. Spending on cybersecurity technology through the channel grew by 16.2% to $18.0 billion, accounting for 91.8% of the total market. Direct spending between customers and vendors, accounting for the remaining 8.2% of the market, declined by 1.8%. For all of 2022, total spending on cybersecurity technology increased by 15.8% to $71.1 billion, while spending through the channel increased by 16.1% to $64.6 billion, representing 91.0% of the total market. Network security accounted for the largest category by revenue in the most recent quarter, by 8.9% to $5.4 billion. Vulnerability and security analytics spending increased by 18.2% to $4.2 billion, and identity access management spending grew by 15.6% to $3.7 billion.

The analysts see the reasons for such fluctuations in rising budget constraints in the IT sphere which made clients make hard choices and prioritize projects. Thus, leading vendors had to struggle for the position on the market.

The leading vendors use the popular ‘land and expand’ marketing strategy, which is highly customer-oriented. It helped to catch up with the previous years and cover a larger share. One of the main aspects was the cybersecurity platform development which offered new functionality through subscriptions. It attracted (landed) new customers and expanded through add-on modules. This action helped the top vendors’ to strengthen their position on the market and survive in critical market fluctuations. On the other hand, the deal size also increased, which led to making sales processes longer and required looking into the projects more thoroughly.

The customers ‘step up investments to improve cyber resiliency’, according to Canalys. The improvement of hardware refresh program base and making sales cycles longer is supposed to constrain the growth slowly in 2023, but it should not affect the cybersecurity sphere as it remains the top priority. Such fields as identity access management, cloud security, security operations center modernization, etc. will stay in the main focus.

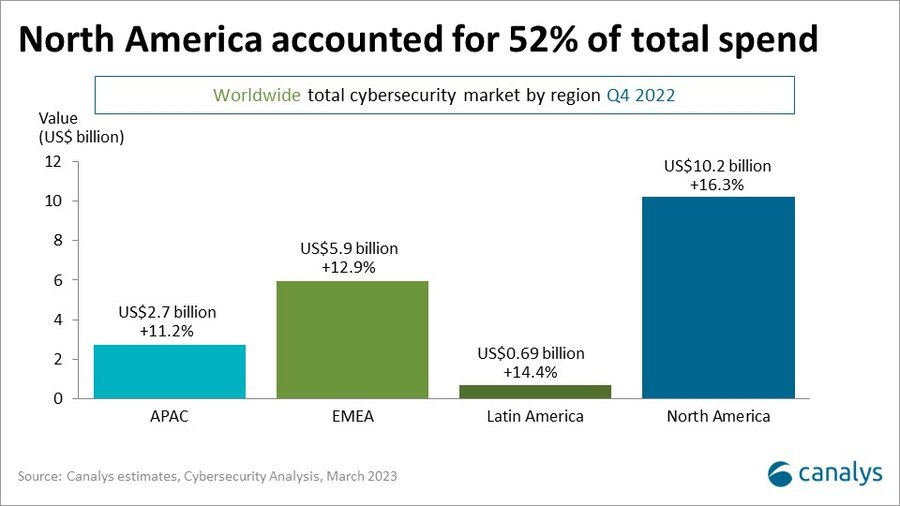

North America covers more than a half of total cybersecurity spending. Source: Canalys

As for figures, North America still covers more than a half of total cybersecurity spending and grew by 16.2 percent in the last quarter of 2022. Cybersecurity is going to be the main topic of the Canalys Forum North America, which takes place in Palm Springs, CA, on November 13th-15th this year.

In Q4 2022 Europe, Middle East and Africa was the second-largest cybersecurity market where spending grew by 12.9% reaching US$5.9 billion. Asia Pacific rose by 11.2% to US$2.7 billion and Latin America grew by 14.4% to US$690 million within the same time period.