Speaking of tokenomics

Tokenomics is the interdisciplinary study of the design, distribution and economic principles behind the creation and use of tokens in a blockchain-based system. More strictly and scientifically speaking, tokenomics is the evolving field of economic coordination games in cryptographically secure P2P networks. Tokenomics encompasses the concept of economic system design and optimization to incentivize certain behavior in a community, using tokens to create a self-sustaining ad hoc economy. It includes game theory, mechanism design, and monetary economics.

The term originated in the development community and has gained traction in scientific circles, but still seems to remain ‘underdeveloped’, because it is often used in different contexts, leading to different meanings when trying to come up with a common definition.[1]

Fig.1 Tokenomics includes game theory, mechanism design, and monetary economics.

In general, we can say that tokenomics is concerned with creating and maintaining a sustainable token ecosystem that provides value to stakeholders. This includes defining the overall supply of tokens, the rate at which new tokens are minted or burned, the mechanisms for distributing and exchanging tokens, and the governance structures that determine how the token ecosystem functions.

Tokenomics is an important aspect for any blockchain / crypto project because it can have a significant impact on the success or failure of a project. A well-designed token economy can encourage users to participate in the network, drive adoption and increase the value of tokens, while a poorly designed token economy can lead to an unstable market, low adoption and a lack of trust in the project.

Why use tokens at all?

Before we ask the question about tokenomics, we should answer another question: why, from the economic perspective, use tokens at all?

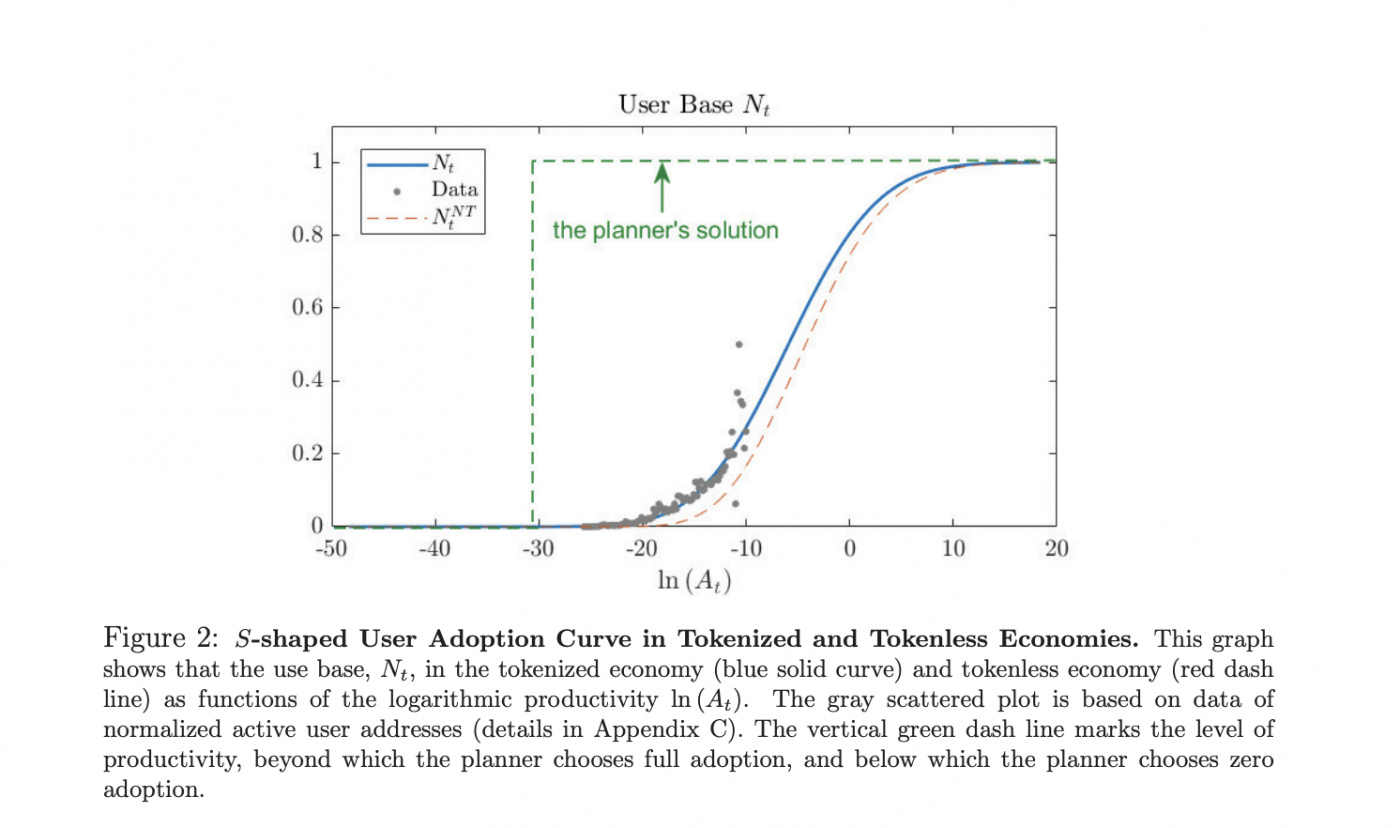

Economic studies show that the introduction of tokens reduces the effective cost of conducting transactions on a platform and, therefore, accelerates the adoption of productive platforms. The introduction of tokens also reduces the volatility of the user base, as agents' expectation of long-term growth in the value of tokens attenuates the impact of temporary performance shocks on the user base.

For example, comparing adoption dynamics in a tokenized and tokenless economy, researchers mathematically conclude that adoption is faster in a tokenized economy than in a tokenless economy [2].

Fig.2 S-Shaped User Adoption Curve in Tokenized and Tokenless Economies. [2]

The difference between tokenomics and economics

Why is token economics often considered not just a subsection of economics as a whole, but a separate field with its own name? Is this a profitable marketing trick or is there really something behind this realization?

One (rather global) viewpoint is really that economics is a broad field that studies economics as a whole, while tokenomics is a specialized field that focuses specifically on token economics and its impact on economic activity. But if you dig deeper and take a closer look, you can find significant features of tokenomics that can be put in opposition to classical economics.

For example, some researchers emphasize that in economics, innovations develop and spread by making changes in the context of established rules and observing how such relatively rigid frameworks respond to change. Therefore, the outcome of a proposed innovation is first evaluated on the basis of prediction. Conversely, in tokenomics, innovation is advanced by designing the rules governing the playing field in such a way that stakeholder behavior is consistent with the goal being pursued. In other words, there is a shift from passively observing the ecosystem's response to change to actively designing the laws that make up the ecosystem to achieve the desired outcome. [3] Thus, we can talk about such an essential global difference between tokenomics and economics as the token economy's proactivity. Another point of view (which, however, overlaps with the first one) is that the big difference between economics and tokenomics is that economics most often starts with predictive goals, and tokenomics mainly starts with design goals.

The basis of tokenomics: the token

Tokenomics refers to the economics of digital tokens, which are units of value that exist on a blockchain or another distributed ledger technology. It involves the study of how these tokens are developed, distributed, and managed, as well as their impact on the broader economy and their users. Tokenomics encompasses a number of processes that are important to the effective functioning of a token-based ecosystem. But basically, in order to calculate good tokenomics, first of all it is essential to have a good understanding of what a token represents in the project.

Fig.3 It is essential to have a strict understanding of what a token represents

The process of tokenization can be described as the encapsulation of value into tradable units of account, called tokens or coins [4]. The disruptive potential lies in extending the concept of shareable and exchangeable value beyond purely economic terms, including reputation, work, copyright, utility, and voting rights. Once tokenized, all of these manifestations of value can be discovered, accounted for, and used in the context of an incentive system that can promote a fair level of redistribution of wealth and power.

A deep understanding of the nature of a token and the ability to comprehensively describe it is as important as it is complex. Given the cornerstone role that tokens play in the tokenization process, their importance is closely tied to the concept of tokenization itself. Following this approach, the definition of a token moves in two directions: on the one hand, it looks at the function performed by tokens, and on the other, it gets to the heart of what they represent.

The value represented by tokens that can be observed in nature is varied and cannot be described unambiguously: it could be the right to a discount on an exchange rate, or the confirmation of ownership of a gold bar, or a reward for solving a mathematical problem to confirm the next block of the chain, or a host of other examples. The challenge is to generalize the definition of value represented by tokens in pursuit of the commonality that all these expressions of value share. When looking in depth at the source of the value represented by tokens, the cornerstone turns out to be the concept of trust.

Tokenomics process

Tokenomics calculations will vary from project to project, depending on the specifics of the underlying systems. For example, many projects work with a fixed supply of tokens, but there are also infrastructure tokenomics models for dynamic systems - researchers calculate the circulating token supply, price, and consumer demand changes as a function of node fees and consumer costs for dynamic infrastructure services, and the methods and results might naturally differ.

But in general, there are basic steps to go through in the tokenomics process:

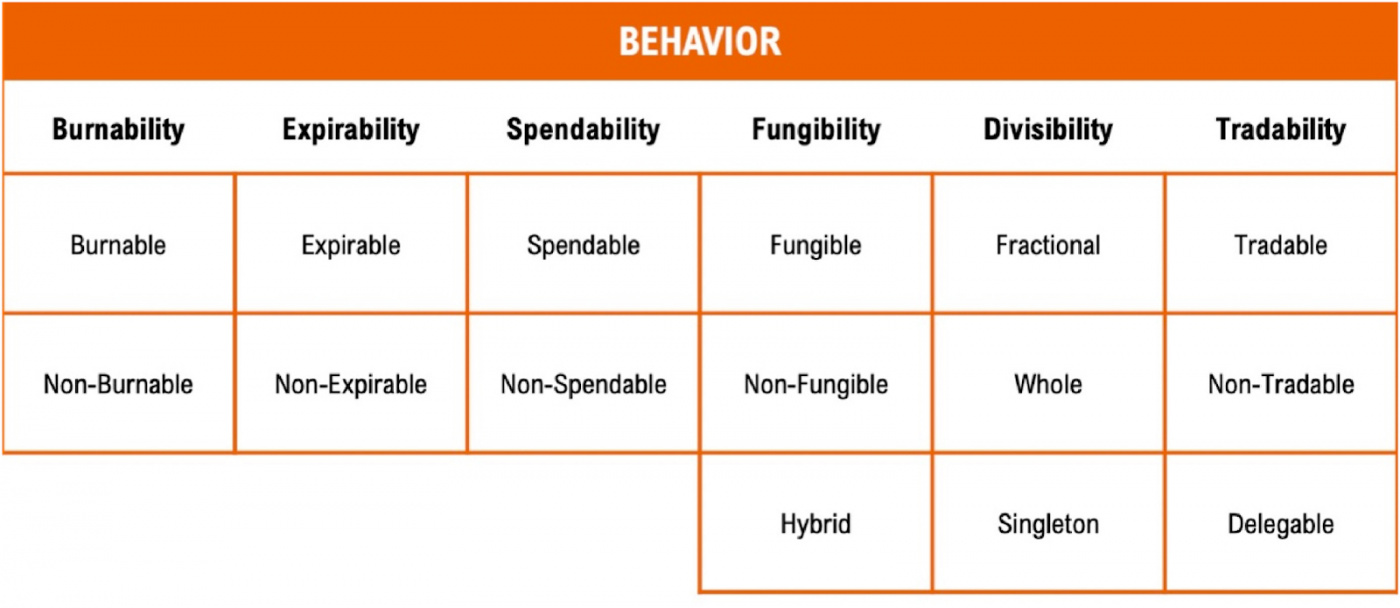

- Token design: Designing a token is the first step in the tokenomics process. It involves defining the purpose, features, and properties of the token. This includes deciding on the name, symbol, delivery, distribution and utility of the token.

Fig.4 Example of token behavior classification. Morphological token classification framework — behavior domain. [3]

- Token distribution: Once the token has been developed, the next step is to distribute it to users. Token distribution can be done through various mechanisms such as initial coin offerings (ICOs), airdrops, or token sales. The goal is to ensure that tokens are distributed fairly and equitably among users.

- Token economics itself: Token economics refers to the economic principles that govern the supply, demand and value of tokens. It involves developing token incentive structures and creating a balance between token supply and demand to ensure price stability and market liquidity.

- Token management: Token management involves creating a system of rules and processes that govern the use of tokens in the ecosystem. This includes creating a structure for decision-making, dispute resolution, and community management.

- Token integration: Token integration refers to the process of integrating a token into various applications, platforms and services. This includes creating APIs and SDKs that allow developers to create applications that can use the token.

- Token acceptance: Token adoption is the process of getting users to use the token in the ecosystem. This includes creating a strong value proposition for the token, creating a community of users, and promoting the token through marketing and information efforts.

- Token maintenance: Token maintenance involves ensuring the ongoing health and vitality of the token ecosystem. This includes monitoring market conditions, updating token economics and governance rules, and addressing security and scalability issues.

Conclusion

Overall, tokenomics is a complex and multi-layered process that involves the development, distribution, and management of tokens in a blockchain-based system. The goal of designing and calculating tokenomics is to create a successful token ecosystem that is sustainable, valuable, and widely shared among users.

Developing a tokenomics model can be a complex process, requiring a deep understanding of economics, game theory, and blockchain technology. Token economics requires a strict understanding of the purpose and utility of a token, as well as the economic and technical factors that influence its value and adoption. Also it is important to use a holistic approach and consider the needs of all parties in the token ecosystem.

We at SmartState provide consulting and support in the design of strong tokenomics for crypto projects as well as tokenomics audits.

If you have any questions about your tokenomics, let's get in touch!

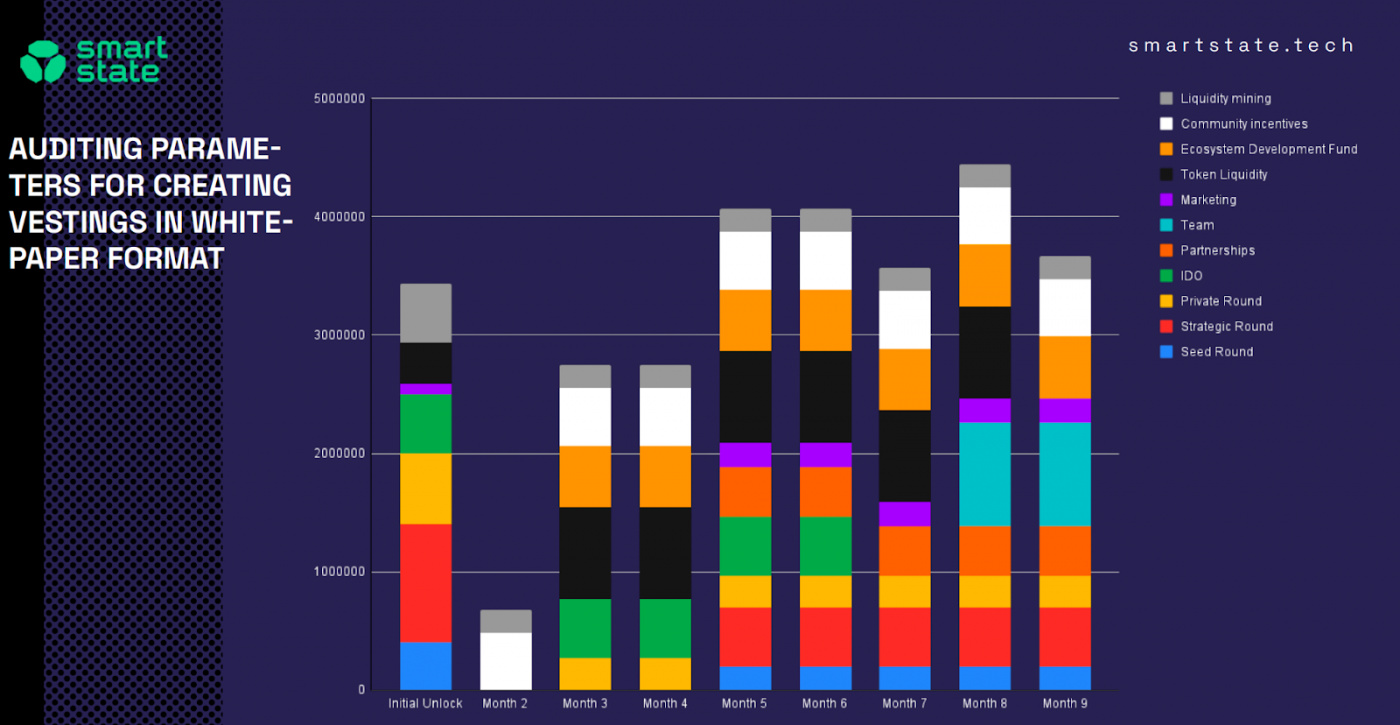

An example of a tokenomics audit report provided by SmartState is available here: https://smartstate.tech/reports/arenum-report-25012022.html

Example of a tokenomics audit report provided by SmartState.

References

[1] Ricky Lamberty, Danny de Waard, Alexander Poddey, Leading Digital Socio-Economy to Efficiency -- A Primer on Tokenomics, https://arxiv.org/abs/2008.02538

[2] Lin William Cong, Ye Li, Neng Wang, Tokenomics: Dynamic Adoption and Valuation https://www.nber.org/papers/w27222

[3] Pierluigi Freni, Enrico Ferro, Roberto Moncada, Tokenomics and blockchain tokens: A design-oriented morphological framework https://www.sciencedirect.com/science/article/pii/S2096720922000094

[4] Pierluigi Freni, Enrico Ferro, Roberto Moncada, Tokenization and Blockchain Tokens Classification: a morphological framework https://www.researchgate.net/publication/347267759_Tokenization_and_Blockchain_Tokens_Classification_a_morphological_framework